BSX

Boston Scientific Corporation

$75.75

2.27

(3.09%)

| Exchange: | |

| Market Cap: | 112.404B |

| Shares Outstanding: | 380M |

About The Company

| Sector: | Healthcare | |||||

| Industry: | Medical – Devices | |||||

| CEO: | Michael F. Mahoney | |||||

| Full Time Employees: | 53000 | |||||

| Address: |

|

|||||

| Website: | https://www.bostonscientific.com |

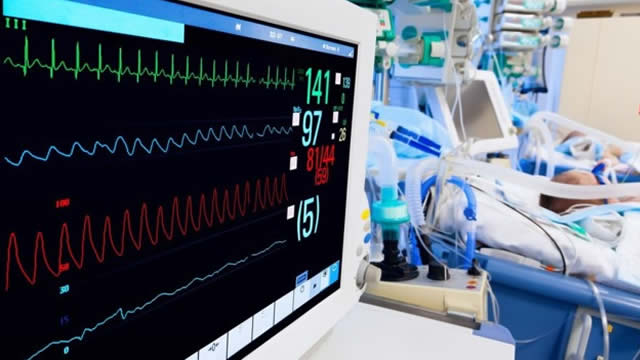

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through three segments: MedSurg, Rhythm and Neuro, and Cardiovascular. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions; devices to treat various urological and pelvic conditions; implantable cardioverter and implantable cardiac resynchronization therapy defibrillators; pacemakers and implantable cardiac resynchronization therapy pacemakers; and remote patient management systems. It also provides medical technologies to diagnose and treat rate and rhythm disorders of the heart comprising 3-D cardiac mapping and navigation solutions, ablation catheters, diagnostic catheters, mapping catheters, intracardiac ultrasound catheters, delivery sheaths, and other accessories; spinal cord stimulator systems for the management of chronic pain; indirect decompression systems; and deep brain stimulation systems. In addition, the company offers interventional cardiology products, including drug-eluting coronary stent systems used in the treatment of coronary artery disease; percutaneous coronary interventions products to treat atherosclerosis; intravascular catheter-directed ultrasound imaging catheters, fractional flow reserve devices, and systems for use in coronary arteries and heart chambers, as well as various peripheral vessels; and structural heart therapies. Further, it provides stents, balloon catheters, wires, and atherectomy systems to treat arterial diseases; thrombectomy and acoustic pulse thrombolysis systems, wires, and stents to treat venous diseases; and peripheral embolization devices, radioactive microspheres, ablation systems, cryotherapy ablation systems, and micro and drainage catheters to treat cancer. The company was incorporated in 1979 and is headquartered in Marlborough, Massachusetts.

Click to read more…

Revenue Segmentation

EPS

Earnings Call

Income Statement

(* All numbers are in thousands)

Balance Sheet

(* All numbers are in thousands)

Cash Flow Statement

(* All numbers are in thousands)

Analyst Estimates

(* All numbers are in thousands)