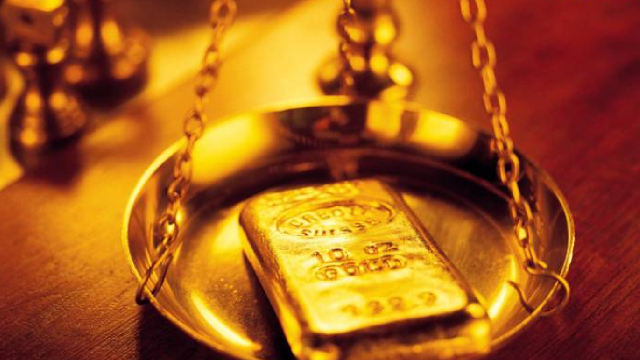

AU

AngloGold Ashanti Plc

$104.89

-3.2

(-2.96%)

| Exchange: | |

| Market Cap: | 52.958B |

| Shares Outstanding: | 43.103M |

About The Company

| Sector: | Basic Materials | |||||

| Industry: | Gold | |||||

| CEO: | Alberto Calderon Phil | |||||

| Full Time Employees: | 12634 | |||||

| Address: |

|

|||||

| Website: | https://www.anglogoldashanti.com |

AngloGold Ashanti Plc operates as a gold mining company in Africa, the Americas, and Australia. Its flagship property is a 100% owned Geita project located in the Lake Victoria goldfields of the Mwanza region in north-western Tanzania. The company also explores for silver and sulphuric acid. AngloGold Ashanti Limited was incorporated in 1944 and is headquartered in Johannesburg, South Africa.

Click to read more…

Revenue Segmentation

EPS

Earnings Call

Income Statement

(* All numbers are in thousands)

Balance Sheet

(* All numbers are in thousands)

Cash Flow Statement

(* All numbers are in thousands)

Analyst Estimates

(* All numbers are in thousands)