GSK

GSK plc

$47.19

-0.67

(-1.4%)

| Exchange: | |

| Market Cap: | 95.949B |

| Shares Outstanding: | 2.368B |

About The Company

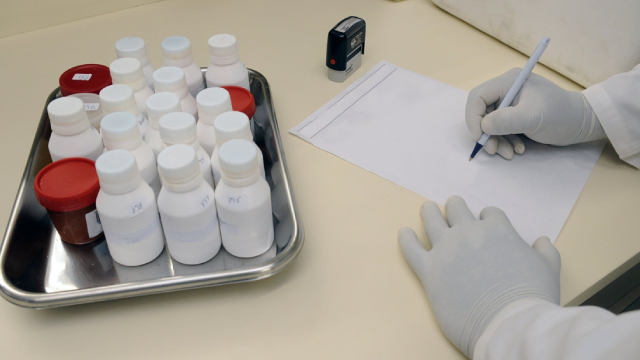

| Sector: | Healthcare | |||||

| Industry: | Drug Manufacturers – General | |||||

| CEO: | Emma Natasha Walmsley | |||||

| Full Time Employees: | 68629 | |||||

| Address: |

|

|||||

| Website: | https://www.gsk.com |

GSK plc, together with its subsidiaries, engages in the research, development, and manufacture of vaccines, and specialty and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally. It operates through two segments, Commercial Operations and Total R&D. The company offers shingles, meningitis, respiratory syncytial virus, flu, polio, influenza, and pandemic vaccines. It also provides medicines for HIV, oncology, respiratory/immunology, and other specialty medicine products, as well as inhaled medicines for asthma and chronic obstructive pulmonary disease, and antibiotics for infections. It has a collaboration agreement with CureVac to develop mRNA-based influenza vaccines, and with Wave Life Sciences and Elsie Biotechnologies, Inc for oligonucleotide platform development; two strategic collaborations with Relation to advance therapeutics for fibrotic diseases and osteoarthritis; and multi-target strategic alliance with GSK to develop breakthrough treatments for people afflicted with Parkinson’s disease; as well as collaboration with Flagship Pioneering to discover novel medicines and vaccines. The company was formerly known as GlaxoSmithKline plc and changed its name to GSK plc in May 2022. GSK plc was founded in 1715 and is headquartered in Brentford, the United Kingdom.dom.

Click to read more…

Revenue Segmentation

EPS

Earnings Call

Income Statement

(* All numbers are in thousands)

Balance Sheet

(* All numbers are in thousands)

Cash Flow Statement

(* All numbers are in thousands)

Analyst Estimates

(* All numbers are in thousands)