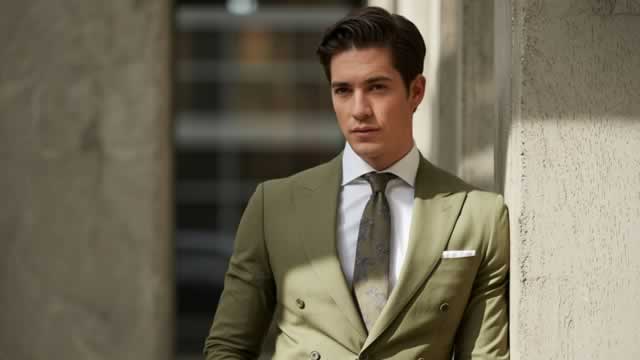

FIGS

FIGS, Inc.

$15.45

2.98

(23.9%)

| Exchange: | |

| Market Cap: | 2.542B |

| Shares Outstanding: | 160.898M |

About The Company

| Sector: | Consumer Cyclical | |||||

| Industry: | Apparel – Manufacturers | |||||

| CEO: | Catherine Eva Spear | |||||

| Full Time Employees: | 303 | |||||

| Address: |

|

|||||

| Website: | https://www.wearfigs.com |

FIGS, Inc. operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States. It designs and sells healthcare apparel and other non-scrub offerings, such as lab coats, under scrubs, outerwear, activewear, loungewear, compression socks footwear, and masks. It also offers sports bras, performance leggings, tops, super-soft pima cotton tops, vests, and jackets. The company markets and sells its products through its digital platform comprising website and mobile app. FIGS, Inc. was founded in 2013 and is headquartered in Santa Monica, California.

Click to read more…

Revenue Segmentation

EPS

Earnings Call

Income Statement

(* All numbers are in thousands)

Balance Sheet

(* All numbers are in thousands)

Cash Flow Statement

(* All numbers are in thousands)

Analyst Estimates

(* All numbers are in thousands)