AAOI

Applied Optoelectronics, Inc.

$84.23

30.54

(56.88%)

| Exchange: | |

| Market Cap: | 5.751B |

| Shares Outstanding: | 8.38M |

About The Company

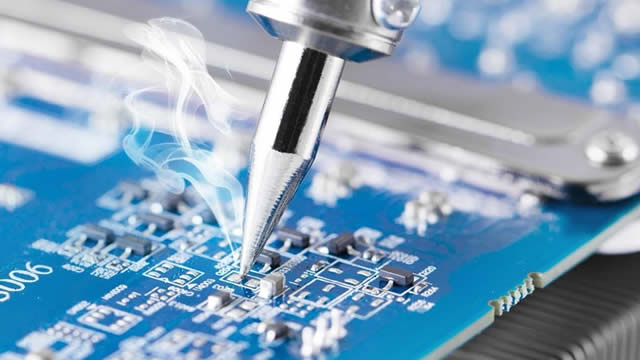

| Sector: | Technology | |||||

| Industry: | Semiconductors | |||||

| CEO: | Chih-Hsiang Lin | |||||

| Full Time Employees: | 3309 | |||||

| Address: |

|

|||||

| Website: | https://www.ao-inc.com |

Applied Optoelectronics, Inc. designs, manufactures, and sells various fiber-optic networking products worldwide. It offers optical modules, lasers, subassemblies, transmitters and transceivers, and turn-key equipment, as well as headend, node, and distribution equipment. The company sells its products to internet data center operators, cable television and telecom equipment manufacturers, and internet service providers through its direct and indirect sales channels. Applied Optoelectronics, Inc. was incorporated in 1997 and is headquartered in Sugar Land, Texas.

Click to read more…

Revenue Segmentation

EPS

Earnings Call

Income Statement

(* All numbers are in thousands)

Balance Sheet

(* All numbers are in thousands)

Cash Flow Statement

(* All numbers are in thousands)

Analyst Estimates

(* All numbers are in thousands)