MRVL

Marvell Technology, Inc.

$79.61

0.52

(0.66%)

| Exchange: | |

| Market Cap: | 67.517B |

| Shares Outstanding: | 121.744M |

About The Company

| Sector: | Technology | |||||

| Industry: | Semiconductors | |||||

| CEO: | Matthew J. Murphy | |||||

| Full Time Employees: | 7042 | |||||

| Address: |

|

|||||

| Website: | https://www.marvell.com |

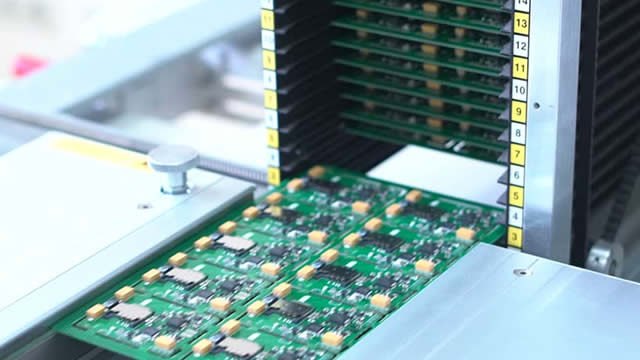

Marvell Technology, Inc., together with its subsidiaries, designs, develops, and sells analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits. It offers a portfolio of Ethernet solutions, including controllers, network adapters, physical transceivers, and switches; single or multiple core processors; ASIC; and printer System-on-a-Chip products and application processors. The company also provides a range of storage products comprising storage controllers for hard disk drives (HDD) and solid-state drives that support various host system interfaces consisting of serial attached SCSI (SAS), serial advanced technology attachment (SATA), peripheral component interconnect express, non-volatile memory express (NVMe), and NVMe over fabrics; and fiber channel products, including host bus adapters, and controllers for server and storage system connectivity. It has operations in the United States, China, Malaysia, the Philippines, Thailand, Singapore, India, Israel, Japan, South Korea, Taiwan, and Vietnam. Marvell Technology, Inc. was incorporated in 1995 and is headquartered in Wilmington, Delaware.

Click to read more…

Revenue Segmentation

EPS

Earnings Call

Income Statement

(* All numbers are in thousands)

Balance Sheet

(* All numbers are in thousands)

Cash Flow Statement

(* All numbers are in thousands)

Analyst Estimates

(* All numbers are in thousands)